|

Simple Solution Organizing Daily Money Management, Professional Organizing & Downsizing

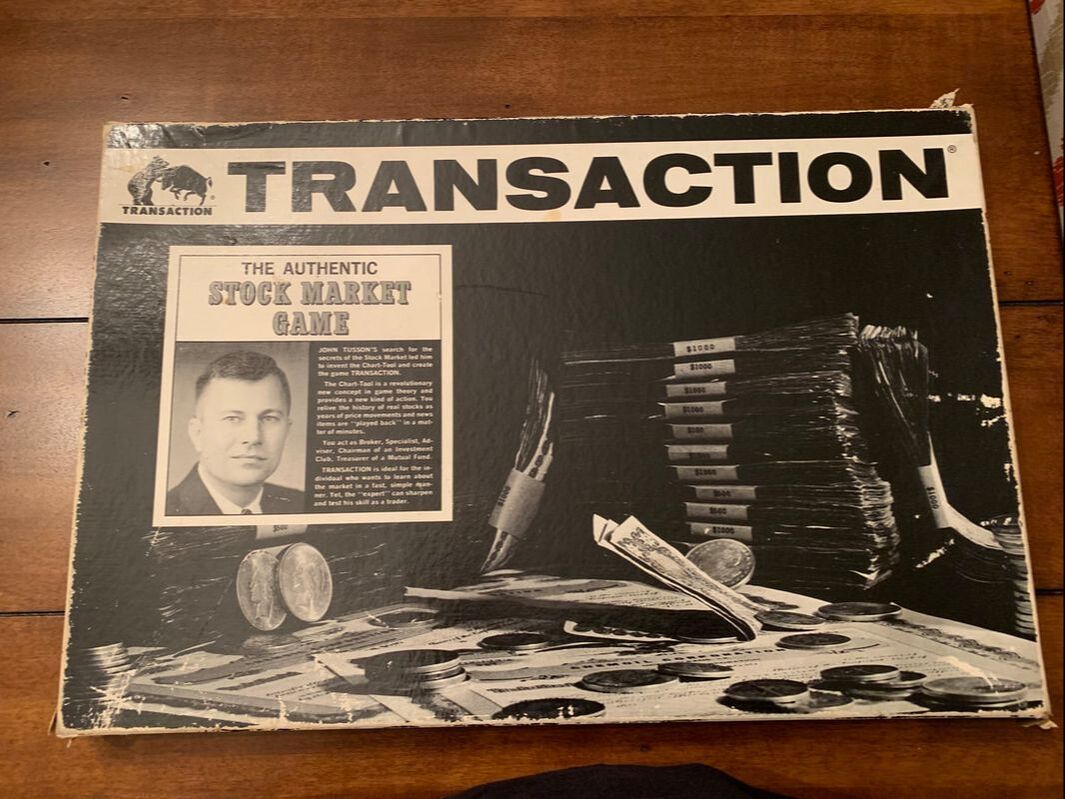

Most people do not like the word budget. Budgeting is associated with restriction and deprivation. Why would anyone want to follow a budget…right? Budgeting can be viewed as an awful experience or a liberating choice. Especially if you want to pay off debts. It takes a lot of discipline to follow a budget. I think parents have a strong influence on their children’s financial viewpoint. Lifestyle choices and financial philosophy towards spending versus saving impact our children. My mom, Pat, paid cash for cars; she did not finance. Pat was frugal; she had to be, living on a Teacher’s salary in Louisiana. She shopped at Thrift Stores and did not buy a lot of stuff. She bought good quality furniture and our house was always neat and tidy (shocking I’m sure!). That was after my mom and dad divorced. My father, John, was the opposite—he was a Hoarder… he bought and kept lots of stuff. I’ll never forget that he purchased all the King Tut items from the New Orleans Museum of Art Gift Shop when the King Tut exhibit was there. I’m not exaggerating and unfortunately someone stole the items out of our home. However, my dad taught me to pay bills when I was only 8 years old and he created a game: Transaction, that was sold to Colleges and Universities designed to teach college students or any adult how to “play” the Stock Market. He was an Inventor and Chemical Engineer. He also was a good delegator teaching me how to write checks, it was an important lesson. Little did we know that I would use this skill in my own business: Financial Organizing and Daily Money Management Services. I try to convince my clients to let me pay their bills electronically but if they are not on board with this idea, I fill out checks for them. My parents had differing philosophies about finances and my husband’s parents were not the greatest financial role models. My father-in-law, Jerry, did not save any money for retirement and my mother-in-law, Susan, did not save enough. My husband, Karl, did not receive the financial education from his parents that he should have and schools did not teach Financial Literacy. My son, Connor, is a Junior in High School and his favorite class is Financial Literacy an Elective. I strongly believe that this class should be mandatory not an Elective. Everyone needs to know how to manage their daily finances, if they want to be successful in life. I handle the financial duties in my household: paying bills, reviewing Credit Card Statements, Investment Statements, monitoring cash flow and renewing Insurance Policies. I have set us up with two Budgeting websites: Mint and Personal Capital. I prefer Mint for two reasons. 1) they have a tool that compares your spending with people of the same financial and age demographics. 2) Personal Capital has one of their Financial Professionals call to review options for Investing with them. I told them to take my name of their list and luckily, they have not called me sense. Both of these websites are free. If you know that you will not follow a budget or maybe you are lucky enough that you don’t need to, I still recommend putting together a financial worksheet which includes:

This will show you the big picture: what you are earning versus expenditures. You also may be surprised by a few discoveries for instance how much money you spend on Starbucks Coffee or your local haunt… Jittery Joe’s where I live, lunches, or clothing. It’s never a good idea to bury your head in the sand when it comes to your hard-earned money. Knowledge is power. You can make informed decisions about spending and saving once you do this extremely important exercise. When you complete the above exercise, you will have the information you need to make a budget; if you choose to. Remember budgeting can be a positive experience and enhance your life significantly. When you take charge of your finances you decide where you spend your money. I was Broke Now I’m Not, IWBNIN, is a great website with free budgeting tools and excel worksheet. According to I Was Broke Now I’m Not: “A written spending plan for your money (or a budget) that includes giving, saving, and spending is critical to achieving financial freedom. There is nothing more powerful than planning your spending BEFORE any of the money ever shows up and BEFORE the month begins.” IWBNIN lists these reasons to start a budget. 5 Reasons why budgeting is important

In addition to I Was Broke Now I’m Not, there are many Personal Budget Websites and Apps that can help you create and monitor a budget. Here are two that are very popular Mint and YNAB, You Need a Budget. Mint is free and YNAB has a small monthly fee. However, if you want to reach savings goals and get very detailed on your budget, I would use YNAB. Nerdwallet is a great website to research everything financial. Do you want help creating a budget and/or setting up Mint or another program? Simple Solution Organizing LLC can help with this process. We are passionate about helping our clients achieve their goals. Adele Tusson-Gross Daily Money Manager, Professional Organizer & Downsizing Expert Simple Solution Organizing LLC 706-714-1314 [email protected] www.simplesolutionorganizing.com Adele Tusson-Gross Chief Executive Organizer

1 Comment

|

AuthorAdele Tusson-Gross Categories

All

|

Simple Solution Organizing LLC

Serving Athens and surrounding cities since 2003

706-714-1314 Cell

Please click here to send us an email

RSS Feed

RSS Feed