|

Simple Solution Organizing Daily Money Management, Professional Organizing & Downsizing

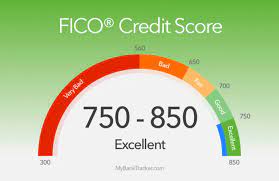

The Top 5 Credit Score Drivers

I recently attended a webinar through my Association AADMM, American Association of Daily Money Managers on Credit Scores. I learned so much and want to share this important information with you. Even if you are at a stage in your life when you don't need to qualify for credit you may have Adult Children or Grandchildren that can benefit from learning how to preserve and grow their credit scores. There are 5 Drivers that affect Credit Scores: 1) Past Delinquencies: 35% of your credit score Make your payments on time. For Collections, request a "payment for deletion" before paying the debt to erase the collection debt from your credit report. 2) Debt Ratio: 30% of your credit score Keep credit card balances under 30% of their limit. Call your creditors to ask which day they report to credit agencies and make payments ahead of the reporting date. Paying down debt on your oldest card will have the most immediate positive impact on your credit score. 3) Average Age of File: 15% of your credit score The longer you have an account open, the more it positively impacts your credit score. Never close down a credit card. 4) Mix of Credit: 10% of your credit score Maintain various types of open accounts. Include revolving and installment lines of credit on your credit report. 5) Inquiries: 10% of your credit score Each time your request credit, a hard inquiry will be placed on your credit report and will likely drop your credit score between 3 and 8 points. You can comparison shop for auto or home financing during a 14-day window, and it will only count as one inquiry. Pulling your own credit score for educational purposes will not effect your overall score. *These tips are ONLY focused on credit scores and do not take into account financial debt and consumer behavior. Therefore, not all of these tips might be applicable to you. Before you take any major action, speak to one of the credit coaches at CredEvolv. This information was obtained from CredEvolv 877-850-3444 [email protected] Happy Summer, Adele Tusson-Gross Chief Executive Organizer 706-714-1314 [email protected] Financial Organizing / Professional Organizing / Downsizing Adele Tusson-Gross Chief Executive Organizer

0 Comments

Leave a Reply. |

AuthorAdele Tusson-Gross Categories

All

|

Simple Solution Organizing LLC

Serving Athens and surrounding cities since 2003

706-714-1314 Cell

Please click here to send us an email

RSS Feed

RSS Feed